2023-07-10 | 2nd quarter 2023 from the perspective of a real estate agent

II. Quarter 2023 from the point of view of a real estate agent

By popular request (nowadays everything is somehow measured and analyzed) we publish quarterly figures, data, and facts about the Berlin real estate market from our practical point of view. Are you thinking about selling or renting? Or do you want to buy or rent? This article will help you in your decision-making process and provide you with a good basis of information on how things look in practice.

Part 1: The real estate market - what is it like in Berlin?

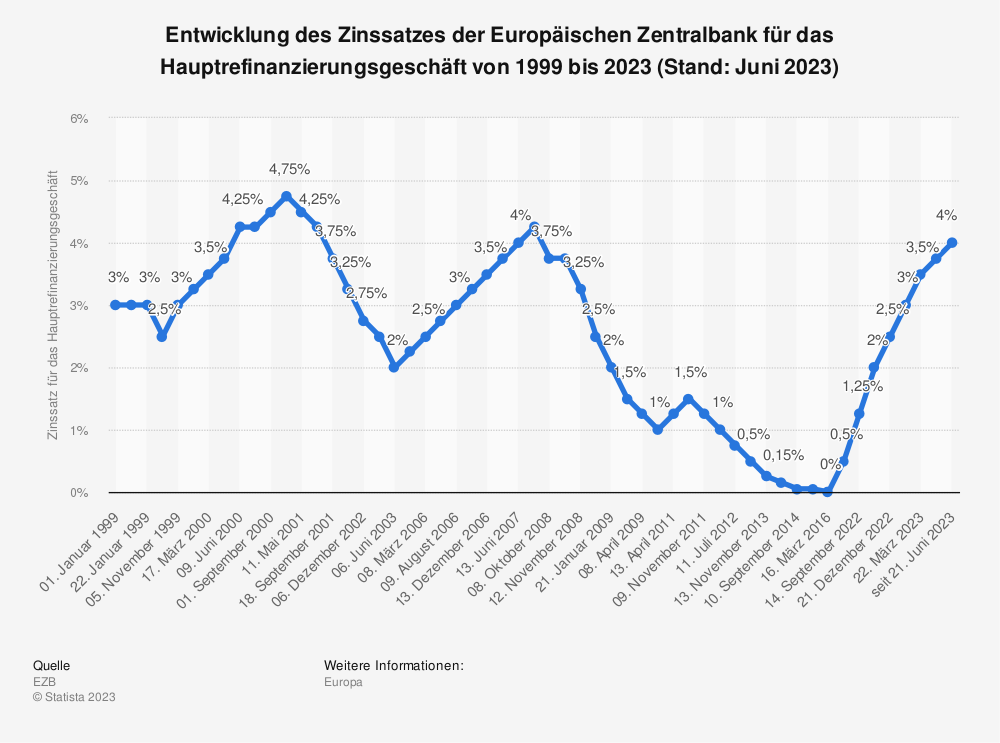

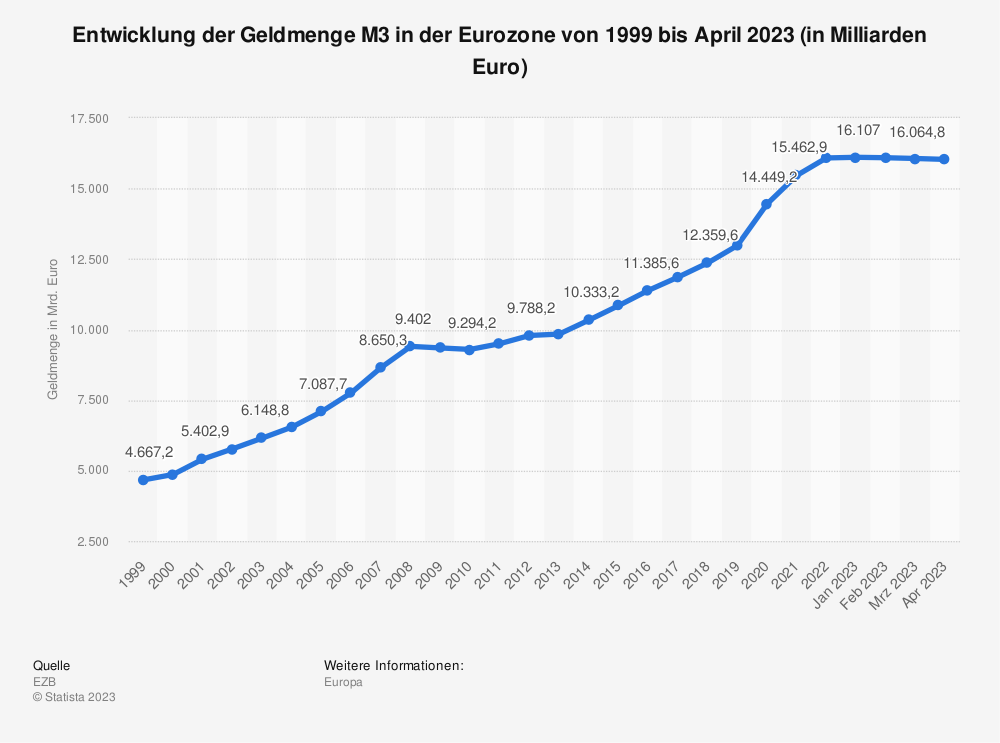

4% interest is the new 1% interest. Few experts believe that there will be a significant reduction in interest rates in 2023 or 2024. The majority opinion says that high inflation will accompany us still some years. As a result, interest rates will also go up and down at times but will no longer fall to all-time lows. This means that we will not reach the peak prices for real estate again for years. Inflation will do the rest. After all, what good is it to possibly achieve the desired price for a property in a few years if the money is then worth less than it is today (keyword: purchasing power)?

Given the current inflation rate of around 6.6%, it might be worth considering selling the property today at a discount of 15% or 20% rather than speculating on possible future increases in value. The idea behind this is to offset the potential loss in the value of money due to inflation.

Clever sellers realized this in 2023 and adapted to the market. People are getting realistic again and analyzing the facts. The risk of rising interest rates has by no means been banished. Even 6% interest rates are quite realistic with the current inflation. This would mean further price declines for sellers.

Recommendation for sellers: It might be more advantageous to sell the property now at a 20%discount and use the money made, instead of possibly having to sell later at a 6% interest rate at a 30% discount. The gains over the last 10 years have been so exceptional that there should be plenty of discretionary cash left over. Alternatively, you can hold the property for a few years, at least 3 years, preferably 5-7 years, and then sell it when the current market cycle ends. Note, however, that during this time high inflation may result in a significant loss of purchasing power.

A very good analysis of exactly this aspect can also be read here in the article by Dr. Rainer Braun - CEO of empirica AG

Part 2: The practice. How is the second quarter for black label real estate - Can we confirm the general market reports and why is this finding relevant for you?

In 2023, we saw a significant decrease in transactions of about 50% in Q1 compared to 2022. This weakness continued into Q2, with lower sales, a lower number of notary appointments, and fewer inquiries. Accordingly, the level remains at a low level. Specifically, there were only 16 notary appointments in Q2, resulting in a total of only 39 notary appointments in 2023.

Both buyers and sellers should expect to see about 50% fewer successful closings and inquiries in general. Many properties have been on the market for 3-6 months and are still waiting for a new owner.

In our current context, buyers and sellers are still relatively far apart, with price differences of around 15% to 20% compared to previous peak purchase prices. However, this gap is slowly narrowing as those who are successful are either buying at a 20% discount or selling at a 20%discount. Other sellers are biding their time, while many buyers are waiting for prices to drop further. Professional sellers are even lowering their prices by as much as 30% to close a "deal" and regain liquidity. However, this applies more to investment properties than owner-occupied properties.

Towards the end of the second quarter, we saw a significant increase in inquiries. Due to the increased demand in response to price reductions in the market, we now expect the market situation to improve with an increase in notary appointments and owner changes. You can find a good article in the WELT about the background of the expected market improvement » here

- Our annual sales currently amount to slightly more than one million euros, and in the first half of the year, we brokered properties with a total value of around 22 million euros.

- The most expensive property in the second quarter was an apartment in a side street of Kurfürstendamm worth over 5 million euros.

- The cheapest property in the second quarter was a plot of land in Brandenburg for 40,000 euros.

It was noticeable that capital investors held back strongly and, according to our information, waited for prices to fall further and rents to rise. Both have already occurred in the first six months of this year. But how much further will rents and purchase prices converge? In any case, it is exciting. At the end of the second quarter, we were able to observe increased demand and even purchases by real estate investors, not just owner-occupiers.

Other facts in the individual market segments:

Our observations show that properties in the mid-price segment of 500,000 to 1 million euros are more difficult to sell due to financing problems. This can be attributed to rising costs of living and a reduced willingness to compromise on location. By contrast, the lower market (under EUR 500,000) and the luxury segment (over EUR 1.5 million) are comparatively stable. A clear focus of many buyers is currently on the periphery, where houses and large apartments can be purchased for under 500,000 euros. It is noticeable that more and more buyers and sellers are approaching us directly via the increased visibility in social media, while inquiries via real estate portals are decreasing significantly.

Despite the weaker market situation, or perhaps precisely because of it, our services continue to be very well remunerated. Demand for our consulting services is high, and many buyers and sellers now want an experienced broker on their side. Expertise, quality, and individual attention are more in demand than ever. However, this also means for us that we do more work, but have fewer notary appointments and therefore less income.

Why is this relevant for you as a buyer or seller? As you can see, the market is not yet in equilibrium. There is a high degree of uncertainty about future developments and values. As brokers, we are therefore required to communicate intensively and find solutions to guide you, our clients, to the desired goal with foresight and transparency.

Tip: If you are a seller, when choosing your broker, make sure that he or she has high visibility on social media. Nowadays, a simple ad on real estate portals is not enough to find the right buyer.

Are you looking to buy or sell a property?

We will help you make a good decision! Book a 30-minute free consultation with one of our managing directors, a real estate agent, or a broker.

Part 3: What it means for buyers and sellers - Now and in the future.

For buyers and sellers, the current situation has both short-term and long-term implications:

- For buyers of a larger property, especially families, there are strategic decisions to make. Given the current market situation, you should focus on the Speckgürtel, where properties can be purchased for under 500,000 euros.

- If you want to live alone or as a couple in the city, you should pay attention to KFW houses, as they offer interest rates of 1-1.5%. This can make a significant difference and give you more and better housing in KFW properties.

- Before buying or selling, a more intensive inspection of the property is required. Make sure all required documentation is in place and check energy ratings. Consider whether improvements are possible and what the costs would be for renovation work.

- Despite higher purchase prices, new construction could ultimately be less expensive due to significantly lower interest rates. To make an informed decision when buying or selling, it is now more important than ever to bring in experts who can inspect the property. Actively inform yourself about the current subsidy programs of the respective countries.

- Deal intensively with the current interest rate movements and future interest rate developments. In the short term, we expect rising interest rates, and in the medium term a normal interest rate of around 4%. Consider what this means for you as a buyer in 10 years or as a seller in 1-3 years.

- Take your time to make an informed decision and be realistic. Waiting can be very expensive for you right now.

Would you like more info on this very topic and do you like podcasts or Youtube videos? Then take a look at our current market report on Youtube at: https://www.youtube.com/watch?v=2CG_gAqsk90&t=1222s

Notes on funding backdrops in the real estate market.

We saw just in the 2nd quarter at the end of June again significantly more purchase inquiries in the market for KFW properties and passive houses. Which market is meant? The market to which the statement refers is the market for owner-occupiers, particularly in the area of KfW properties and passive houses. The increased demand refers specifically to properties that are up to date in terms of energy and take advantage of the KfW subsidy program. These include passive houses, for example, which have virtually no energy costs, or KfW40 apartments with very good energy efficiency.

Here we almost have a small run. Why?

- Cost savings: KFW properties and passive houses are characterized by their energy-efficient construction, which can lead to significant savings on energy costs. With favorable interest rates, you can realistically finance these properties, and have a good monthly payment even with little equity.

- Environmental awareness: energy efficient properties offer the opportunity to reduce your energy consumption and the associated CO2 emissions.

- You live healthier: Energy-efficient houses almost all have a better indoor climate with less pollen and pollution, are cooler in summer and warmer in winter than normal properties.

- Long-term appreciation: KfW properties and passive houses are often considered future-proof because they meet current energy-efficient standards. This can lead to these properties performing better and increasing in value over the long term.

We recommend

- that you with an independent financing advisor for more information and to address your specific financing questions.

- Seek a qualified energy consultant who can help you assess a property's energy use and costs, identify potential savings, and make recommendations for energy improvements.