2023-02-27 | Family Office for Private Individuals

Family Office for Private Individuals

WHO IS ACTUALLY BENEFITING FROM THE CURRENT GERMAN REAL ESTATE MARKET AND WHAT OPPORTUNITIES DO YOU HAVE AS A WEALTHY PRIVATE INDIVIDUAL?

We hear more and more often that cash is king. This is normal in a market change like the one we are experiencing now, because the banks are withholding financing or increasing their equity requirements for potential buyers.

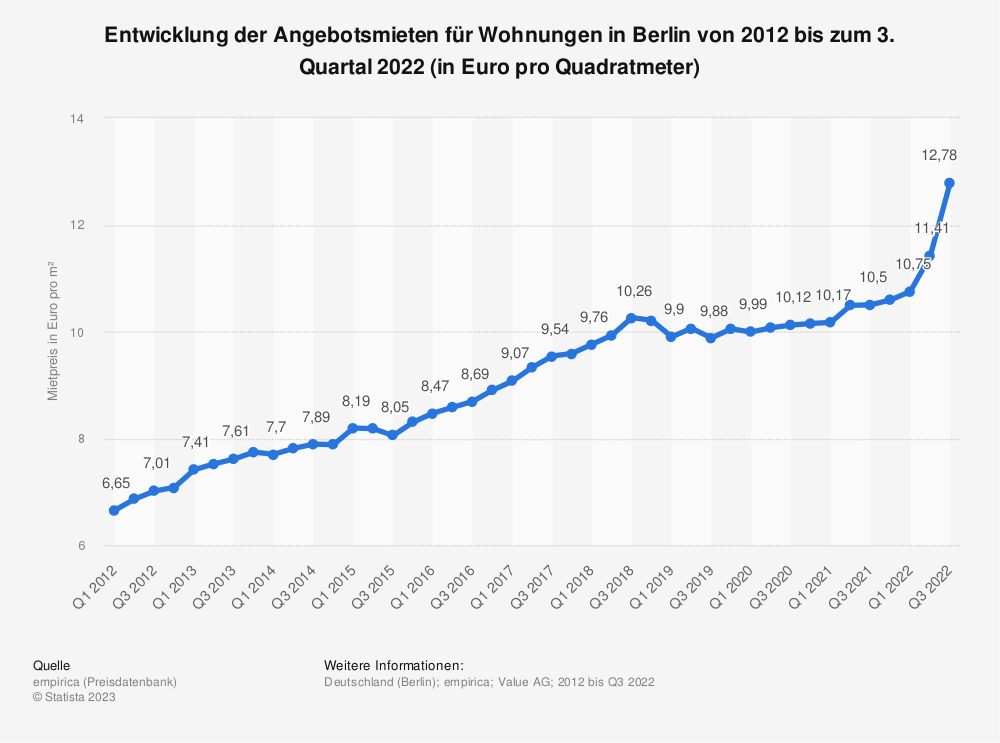

One of the consequences of this is that by 2023 it will be almost impossible for a family of three with €5,000 net per month and €75,000 in savings to get into adequate residential property within Berlin's S-Bahn ring. The family's only option is to move away or buy a smaller condominium on the outskirts of Berlin.

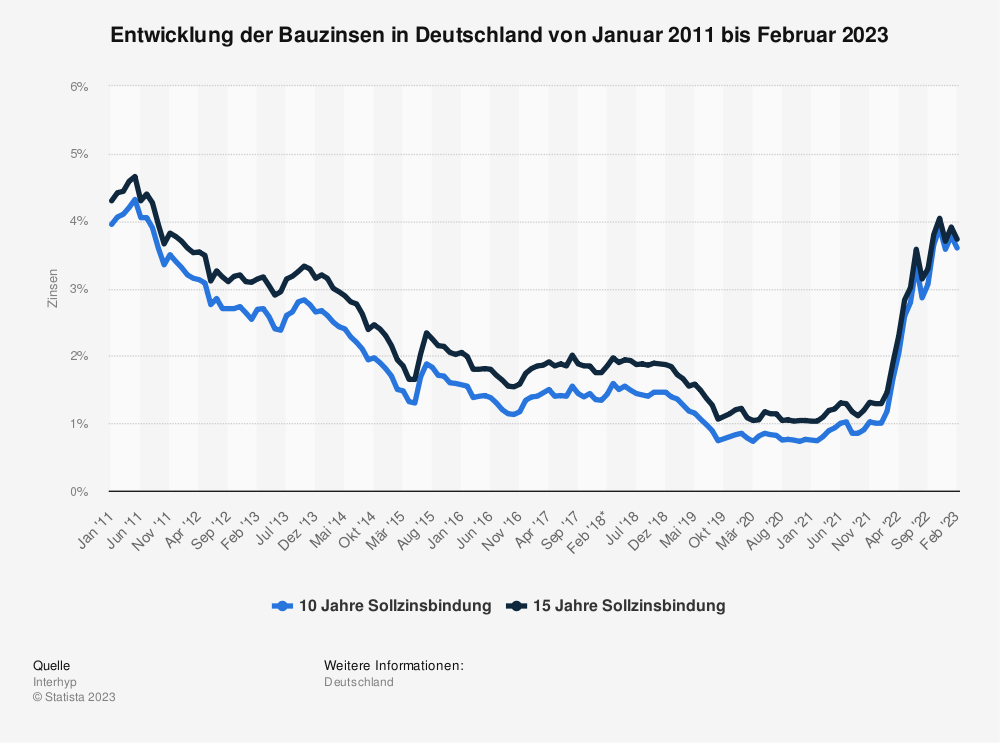

We are talking about the upper middle class here. Families who have €5,000 net per month at their disposal and a very tidy reserve fund have no existential fears. However, despite their desire for home ownership, they have not managed to get into their own house or flat in recent years. And this despite sensationally low interest rates until 2022, the possibility of long-term fixed interest rates and a stable to good economic and political situation. That's a pity, because ultimately home ownership is the only real way for city dwellers to get out of Berlin's over-regulated and distorted rental market.

Those who now hope for sharply falling property prices forget that there are many people who have saved much more money or come from wealthy families. These people often have 30-50% of the purchase price in cash and are thus immediately ready to act. They can buy residential property without long negotiations with lenders. Especially from residential properties whose owners bought their property 10 or more years ago. These properties were bought back then at 50-75% below current market value and price drops of 10-20% are not critical to these sellers.

It is true that we are currently experiencing a downward correction in property prices. But - the demand for real estate is greater than the supply. This will remain the case in the medium term, as construction activity is declining due to the loss of buyer groups, increased construction costs and bureaucracy. Property values will therefore rise again in the medium to long term.

It is a pity that the many first-time buyers and young families cannot benefit from the current falling prices due to a lack of capital.

THE PROFITEERS IN THE CURRENT MARKET ARE BUYERS WITH CAPITAL.

Since rents in new rentals and in new construction are rising and will certainly continue to rise, it is now time for all those with access to capital to become active.

Yields are once again achievable in the housing market that were unthinkable in recent years. Thanks to the return of interest rates, the factors will settle between a factor of 20 and 25, depending on the location. In any case, the times of factors of 35 and more are over.

The ECB will continue to raise interest rates. What else can it do with the current inflation? The only question is how long it can continue to do so and when the first major collateral damage will occur. We expect that the first well-known builders and property developers will leave the market in the summer of 2023. The land speculators are already out of the market. Land prices for larger houses are already falling.

"We advise wealthy families and investors to prepare now for the coming market by building professional structures and looking closely at properties."

This means talking to good lawyers about how you can set up an appropriate corporate structure to best protect your capital and invest in the properties that come up. We assume a time window of 1 to 2 years. After that, the purchase prices for real estate will rise again. Especially if rents continue to increase and inflation plays its part in the loss of value of uninvested capital.

Wealthy private individuals, investors or capital investors:

BOOK AN INDIVIDUAL AND FREE ONLINE CONSULTATION HERE.

Many wealthy individuals do not have the time, expertise or interest to take care of their investments themselves. We work together with strong and experienced partners who provide you with full support in securing and increasing your assets. Let us advise you in detail and free of charge.

WITH GOOD "ASSET MANAGEMENT" YOU CAN BENEFIT FROM CURRENT MARKET OPPORTUNITIES.

Asset management manages and invests into different types of real estate for wealthy individuals. Family offices manage and invest the capital of high-net-worth individuals. We speak of a small family office when the capital assets are approx. 2.5 million EUR. However, the limit is not fixed. Several families can also join forces to share the infrastructure costs of the service provider.

If you are wealthy or affluent, you should intensively consider the establishment of professional structures in a timely manner:

- When it comes to legal issues, we recommend that you talk to experiences international lawyers such as » Mr. Volker Mauch of VPMK and lawyer and notary » Mr. Dennis Fortkamp about this. Both legal offices can set up an infrastructure for you in which you can optimally invest your assets as a family.

- As a real estate service provider and brokerage house, we can search for and find you the right properties for this purpose. Through our partner, the asset manager Perfaktum GmbH, we set up the right structures for you.